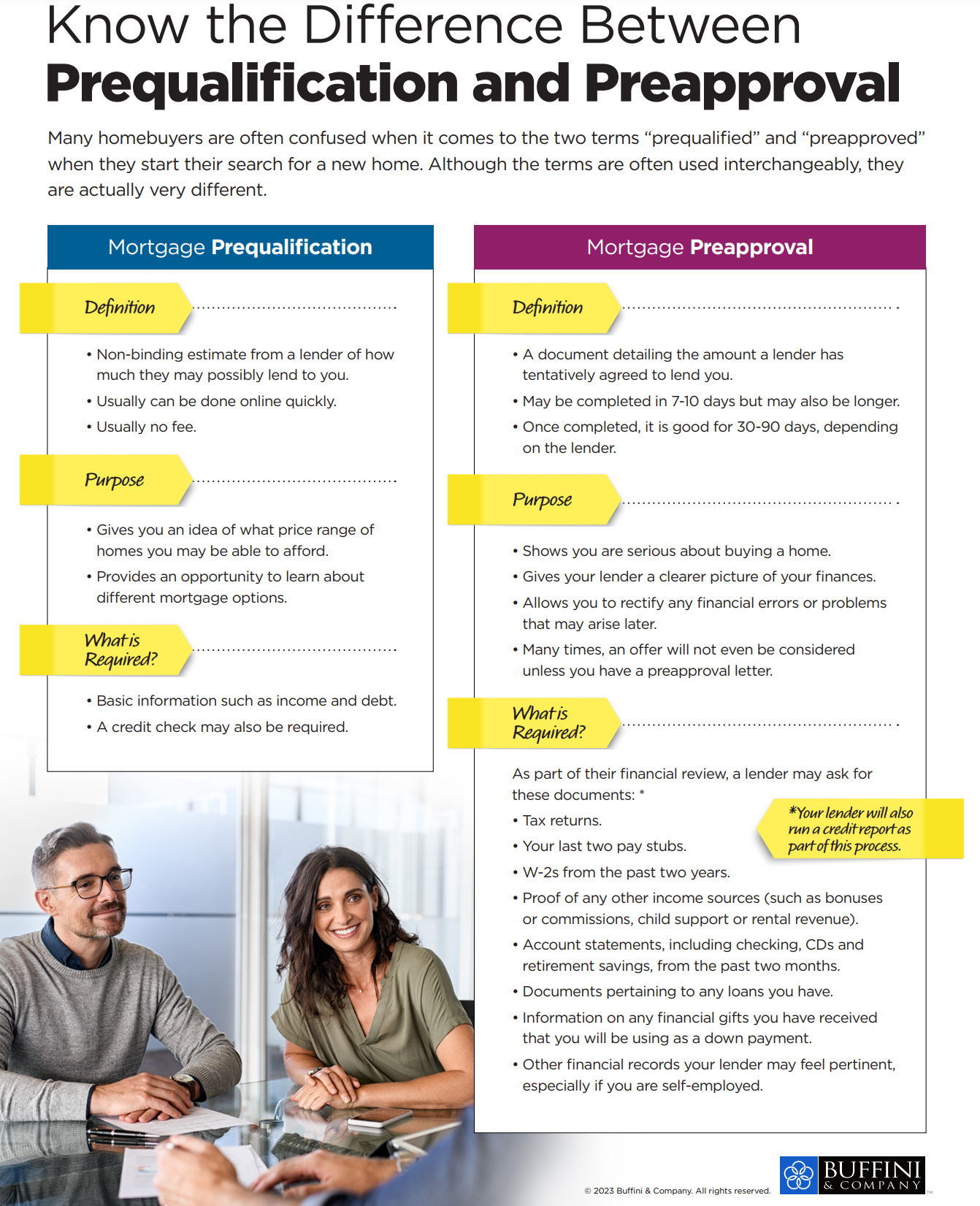

Understanding the distinctions between mortgage prequalification and preapproval is crucial for any homebuyer navigating the real estate market. While both processes involve assessing your financial readiness for a mortgage, they serve different purposes and carry varying degrees of certainty.

Prequalification typically involves a basic assessment of your financial information provided by you to a lender. It offers a general estimate of the mortgage amount you may qualify for based on your income, debt, and assets. However, it doesn’t involve a thorough analysis of your credit report or documentation verification. As a result, prequalification provides an initial indication of affordability but lacks the firm commitment necessary to make competitive offers on properties.

On the other hand, preapproval entails a comprehensive evaluation of your financial background by a lender. This process involves submitting documentation such as income statements, tax returns, and credit reports for thorough review. Upon completion, the lender issues a conditional commitment to lend you a specific amount, subject to appraisal and other conditions. Preapproval carries more weight in the eyes of sellers and real estate agents, demonstrating your seriousness and ability to secure financing.

In summary, while prequalification offers a preliminary estimate of your mortgage eligibility, preapproval provides a stronger, more reliable indication of your purchasing power. Understanding the differences between the two can empower homebuyers to make informed decisions and navigate the homebuying process with confidence.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link